Climate Action: Move Your Money & Switch Your Credit Card

One Friday night in the fall of 2012 I found myself in a room at Amherst College with Bill McKibben, a good number of college students, and some local residents, many of them in their later years. I was only just beginning to really pay attention to the issue of climate change and thought of myself as a visitor or observer in this gathering. McKibben looked like a very ordinary guy, but once he started to speak, the power of his vision and persuasion transformed the room. At that point, no college or other institution had committed to divest from fossil fuels, but McKibben announced his intention to start a nation-wide divestment movement.

It seemed unlikely that such a movement could have much impact on an industry as wealthy as the fossil fuel industry. McKibben explained that he didn’t expect to bankrupt the industry, but rather to cause them to be seen as moral pariahs for their climate-destroying business model and to delegitimize the power they wield through political donations. He thought college students and alumni could effectively pressure colleges and universities to divest, and he announced a cross-country tour to enlist them. This made sense to me and I soon wrote to my alma maters encouraging them to divest from fossil fuels.

$40 trillion

Fast forwarding to the present … the divestment movement that Bill McKibben announced in Amherst that night has grown. More than 1500 institutions–colleges, pension funds, faith-based organization, etc.– whose investments total more than $40 trillion, have divested from fossil fuels. When Peabody Coal filed for bankruptcy a few years ago they listed divestment as one of the reasons. A Shell annual report included divestment as one of a few issues that could negatively affect their business.

Now activists around the world are pressuring banks and other financial institutions to stop financing the fossil fuel industry. McKibben credits Indigenous leaders in Canada who went to the European banks to try to get them to stop funding the extraction of the dirty Alberta tar sands oil, with beginning this tactic.

Banks are accomplices that must not escape responsibility

Speaking last year, UN Secretary-General António Guterres said the fossil fuel companies and the banks that finance them “have humanity by the throat“. He called the banks “accomplices” in creating climate disaster and insisted that they “must not escape responsibility.”

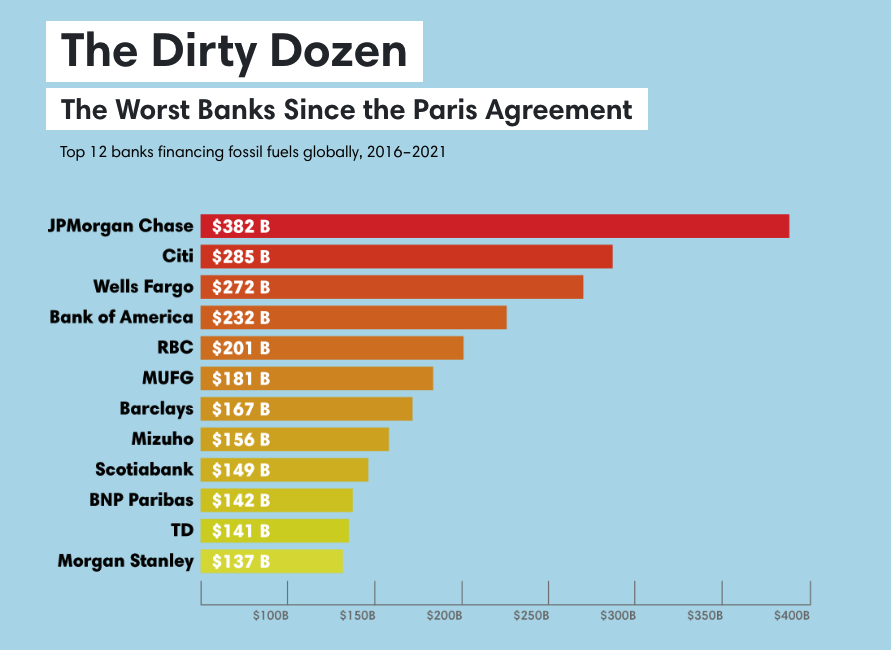

Banks and fossil fuel companies are deeply intertwined. According to the “Banking on Climate Chaos” report, since the 2015 Paris climate agreement, the 60 largest banks in the world have invested $4.6 trillion in the fossil fuel industry. JPMorgan Chase is by far the worst, with huge investments in fossil fuel companies and in fossil fuel expansion. The list of the biggest investors in climate destruction continues with CitiBank, Wells Fargo, Bank of America, and Royal Bank of Canada.

Success!

Outside of North America, activists have had some successes. Last year HSBC, the largest bank in Europe and eight largest in the world, announced that it would make no new investments in fossil fuel projects and would seek to invest a trillion dollars in green energy by 2030. Big banks in Europe responded to shareholder pressure by reducing their fossil fuel financing by 28% in 2021. But the big U.S. and Canadian banks are still expanding their climate-destroying investments.

Third Act

In 2021 Bill McKibben and some colleagues launched a new organization called “Third Act” to engage people over 60 years old in climate activism and in safeguarding democracy in the U.S. They are calling for a National Day of Action on March 21 to “Stop Dirty Banks.” Everyone is invited to hold local rallies, move their money out of these banks, cut up their credit cards from these banks, and help everyone understand the connection between where you bank and the climate crisis. More than 70 actions are planned across the country. Maybe there’s one near you. The local group that I’m working with is planning a rally that will include a brass band, young people, faith leaders, senior citizens, and a giant pair of scissors to cut up a giant Chase Bank credit card. You can see our flyer here.

Switching my credit card

I was surprised to discover in the fine print on the back of the credit card I’ve been using (which I got through an airline) that it is actually managed by one of the “Dirty Dozen”– the 12 banks providing the most financing for fossil fuels globally. So I’ve just switched to a Green America Visa card. I haven’t had enough experience with it to know whether to recommend it to you, but I like everything I’ve read about its features and the bank behind it.

It’s so easy to feel powerless in the face of the climate crisis, but one thing we can control is where we put our money.

Woman at a recent meeting of our local group

I urge you to make sure your money isn’t being used to expand fossil fuels by moving any money you have in the dirty banks. Small local banks and credit unions tend to be good options. Switch your credit card to a green bank. “Stop the Money Pipeline” has a good toolkit for these switches. Acting together, we can send a powerful message to the financial industry that their days of funding fossil fuels must end.

________________

The photo above was taken in Palo Duro Canyon State Park, Texas, by Russ Vernon-Jones.

I’ll let you know when my next new post is available.

Click “Subscribe” below.

Do you know if Venmo and Paypal intersect with these Dirty Banks?

I’m not an expert about the banking practices of Venmo and Paypal. As far as I can tell, Venmo and Paypal both use Synchrony Bank, which is not among the top 60 investors in fossil fuels. So I think that’s OK.

On the other hand, the credit cards that both Venmo and Paypal offer are through Bancorp Bank, which is the 13 largest financier of fossil fuels in North America. So I would avoid either of their credit cards.Doing some further research on August 1, 2023 in response to a reader’s comment, I found that the Venmo Visa card is now through Synchrony Bank and seems fine to use. The Venmo Mastercard appears to still be through Bancorp Bank and I would avoid it.